Relative Poverty and Income Tax in OECD Countries

10/15 2024

Author: Naoto Yoshikawa, Ph.D.

In line with SDG 1 to address poverty “… in all its forms everywhere,” OECD countries must also confront this issue. Although poverty in OECD countries differs from that in developing countries, relative poverty* remains a significant concern. Relative poverty is defined as income below half the median household income of the total population. In OECD countries, the proportion of people experiencing relative poverty remains substantial and has shown little sign of improvement (OECD 2024/a). According to OECD statistics from 2021, the 10 OECD countries with the highest rates of relative poverty are Costa Rica (20.3% of the population), Israel (17.8%), Estonia (16.5%), Latvia (16.0%), Japan (15.4%), the USA (15.2%), South Korea (14.8%), Spain (14.4%), Turkey (14.0%), and Lithuania (13.6%) (OECD 2024/a).

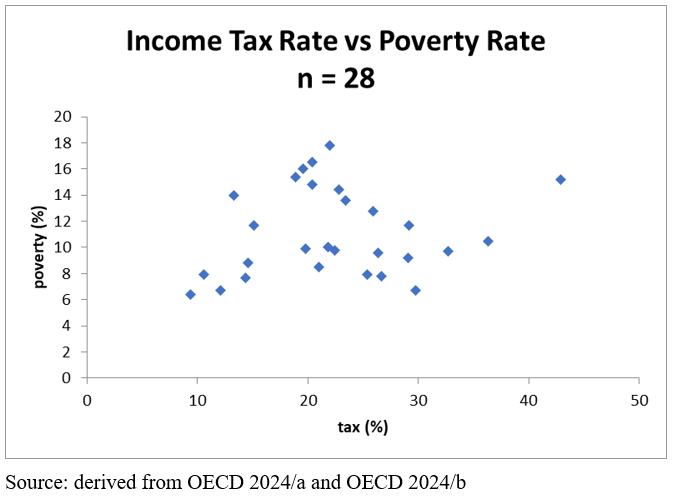

Countries with higher income tax (tax on personal income)* rates are generally believed to have better welfare systems, which means lower poverty rates. Nevertheless, does this hypothesis hold true in relation to relative poverty? This analysis explores whether OECD countries with high-income tax rates have lower relative poverty rates. The top OECD countries with the highest income tax rates in 2021 are Denmark (52.81% of income), the USA (42.90%), New Zealand (40.88%), Australia (39.00%), Canada (36.32%), Ireland (32.75%), Switzerland (30.35%), Finland (29.79%), the UK (29.16%), and Sweden (29.07%) (OECD 2024/b). The graph below combines these poverty rates and income tax rates.

Although this graph only includes 28 countries, no clear relationship exists between higher income tax rates and lower poverty rates. In fact, the p-value for this analysis is 0.39961, indicating no statistically significant linear relationship between poverty rates and income tax rates. This finding suggests that high-income taxes do not necessarily translate into low-income household benefits. Differences in government policies and spending priorities likely explain this inconsistency, as some governments may not prioritize poverty reduction/eradication in their welfare strategies.

For instance, Japan’s income tax rate is 18.86%, which is below the OECD average of 23.71% (OECD 2024/a &/b). Yet Japan ranks fifth in the OECD for relative poverty, with 15.4% of its population living in poverty. Other countries with lower income tax rates than Japan—such as Greece (15.15% tax rate, 11.7% poverty rate), Poland (14.57%, 8.8%), Slovenia (14.33%, 8.8%), Turkey (13.27%, 14%), and Hungary (12.10%, 6.7%) - all countries report lower poverty rates (OECD 2024/a &/b).

These observations suggest that achieving the first SDG, eradicating poverty, will not be possible without a concerted effort by governments to implement effective policies and allocate resources toward poverty reduction and eradication.

* Definition

(Relative) Poverty”

“Poverty rate is the ratio of the population whose income falls below the poverty line. The poverty line is taken as half the median household income of the total population. The population affected is broken down by broad age groups: child poverty (0-17 years old), working-age poverty (18-65 years old) and elderly poverty (66 year-olds or more). Note that countries with the same poverty rates may differ in terms of the relative income-level of the poor.” (OECD 2024/a)

“Income Tax (Tax on personal income)”

“Tax on personal income is defined as the taxes levied on the net income (gross income minus allowable tax reliefs) and capital gains of individuals. This indicator relates to government as a whole (all government levels) and is measured in percentage both of GDP and of total taxation.” (OECD 2024/b)

Reference

World Bank (WB) (2024) Understanding Poverty: Poverty (April 2, 2024) http://www.worldbank.org/en/topic/poverty/overview (last visited, Oct.7, 2024)

Organisation for Economic Co-operation and Development (OECD) (2024/a) Poverty Rate https://www.oecd.org/en/data/indicators/poverty-rate.html (last visited, Oct.7, 2024)

Organisation for Economic Co-operation and Development (OECD) (2024/b) Tax on Personal Income https://www.oecd.org/en/data/indicators/tax-on-personal-income.html?ecdcontrol-00b22b2429-var3=2021&oecdcontrol-3422f520c2-var8=PC_TOT_TAX (last visited, Oct.7, 2024)